Community Investment Tax Credit

Invest in Roxbury

Invest in Roxbury — Give to Madison Park Development Corporation!

Your investment in our work is a great way to stretch your philanthropic dollars. This year Madison Park Development Corporation offers a special tax credit to our donors.

Your gift in support of MPDC programs will help strengthen and secure the lives of individuals and families in the Roxbury community. Our programs create positive pathways for youth and build the power of Roxbury residents through civic engagement. They also address community challenges such as health disparities in our neighborhood by providing access to healthy food, physical fitness, and health and wellness education. Hibernian Hall at MPDC provides affordable access to high-quality arts for our community and supports emerging and established local and regional artists. MPDC’s Dewitt Center is a thriving community educational & recreational space. Your gift can also support MPDC’s fundamental mission of creating and preserving affordable housing and supporting the revitalization of the Nubian Square commercial district.

How will your donation be put to work?

Your investment in our work is a great way to stretch your philanthropic dollars. Madison Park Development Corporation offers a tax credit to our donors through the Massachusetts Community Investment Tax Program (CITC).

The Massachusetts Community Investment Tax Credit Program (CITC), provides a 50% state tax rebate for donations of $1,000 or more. If the credit exceeds your liability, the state refunds the balance of the credit.

Your gift of $1,000 or more helps strengthen the heart of Boston and improve the lives of local residents by supporting MPDC programs that:

- Create & preserve affordable housing

- Address community health disparities

- Offer affordable access to culturally relevant arts

- Build grassroots leaders

Give Early! Tax credits are limited.

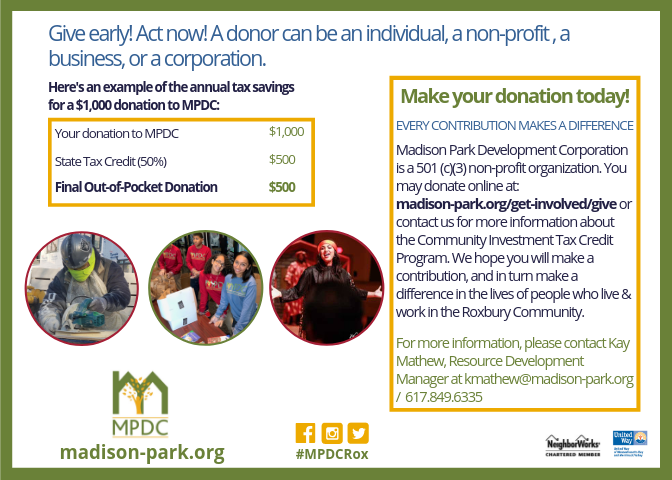

Our donors can be individuals, nonprofit institutions, businesses, or corporations.

Annual Tax Savings for a $1,000 Donation

| Your donation to MPDC: | $1,000 |

| State Community Investment Tax Credit: | $500 |

| Final Out of Pocket Donation: | $500 |

This illustration does not include your federal tax deduction on the same donation, which could increase your total tax savings.

MAKE A DONATIOn Today!

For More Information, Please contact Kay Mathew / 617.849.6335

How to Give to MPDC

You can make credit card donations online here:

You can also make a donation by check through the mail. Checks should be made out to Madison Park Development Corporation.

Mail Checks to:

Madison Park Development Corporation

184 Dudley Street

Roxbury, MA 02119

There are many ways you can donate:

- One-time gift – Online with your credit card – Make A Donation

- Monthly Pledge – Online with your credit card – Make A Donation

- Membership in Friends of Hibernian Hall – Learn About Friends of Hibernian Hall

Gifts can be designated to support a specific MPDC program including:

The Dewitt Community Center:

- Educational & recreational programs for the entire community

Hibernian Hall:

Become a Friend of Hibernian Hall at one of these levels:

- Student $10

- Older Adult $25

- Adult $50

- Organization $250

Community Action:

- Youth Leadership and Workforce Development

- Community Engagement

- Health Equity and Community Wellness

- Community Support

For More Information, Please contact Kay Mathew / 617-849-6335.